estate tax changes in reconciliation bill

While in the Senate a few. The House passed the Inflation Reduction Act of 2022 IRA on August 12 which was signed into law by President Biden on August 16.

Tpc The Ways Means Reconciliation Bill Would Raise Taxes On High Income Households Cut Taxes On Average For Nearly Everyone Else

The Inflation Reduction Act of 2022 IRA has taken a step forward as the Senate completed its deliberation and passed the bill on August 7.

. The Presidents plan will close this loophole ending the practice of stepping-up the basis for gains in excess of 1 million 25 million per couple when combined with. 32 billion to increase taxpayer services including pre-filing. By a vote of 51 to 50 the US.

Senate on Sunday passed a budget reconciliation bill HR. 4 hours agoTax brackets 401k contribution limits and estate and gift tax thresholds are expected to get the biggest inflation adjustments in decades. The budget reconciliation bill commonly referred to as the Inflation Reduction Act was signed into law in August.

Reconciliation Bill Tax Changes. The bill allocates funding as follows. The bill provides that taxpayers with AGI of 400000 or more and all trusts and estates would only be allowed to exclude 50 of the eligible gain.

The bill increases funding for the IRS by 80 billion over the next 10 years. The Westport Democrat said senators want to raise the estate tax threshold from 1 million to 2 million while also providing a uniform tax credit of 99600 to estates above. The latest draft of the US Congress budget reconciliation Bill omits most of the previously proposed tax changes that would have affected US estate.

The reconciliation bill repackaged by Democrats as the Inflation Reduction Act of 2022 would raise an estimated 739 billion over the next decade with the revenues going. While the IRA contains far fewer tax. The top marginal income tax rate would increase from 37 to 396 for high-income individuals 450000 for married individuals filing jointly.

In late October the House Rules Committee released a revised. As negotiations over spending and taxes in a potential budget reconciliation bill tentatively the Build Back Better Act are ongoing in Congress Democrats on the House Ways and Means. Imminent Tax Changes Stemming from Reconciliation Bill After over a year of discussion debate and various.

All 50 Senate Democrats. Potential Tax Changes to Real Estate Partnerships in Budget Reconciliation Bill. Draft legislation could have potentially substantial tax impacts to partnerships in real estate and other.

5376 the Bill proposes sweeping changes to tax rules that apply to individuals and trusts with far-reaching implications for. Income Tax Changes Proposed. The 700 billion-plus legislation represents only a fraction of the.

5376 now known as the Inflation Reduction Act of 2022The bill contains numerous. Senate this afternoon August 7 2022 passed budget reconciliation legislation HR. 5376 that includes significant tax law changes.

The Infrastructure Bill passed the House and President Biden signed it into law on November 15th yet Congress continues to debate the repayment details of the Budget. Revised Build Back Better Bill Excludes Major Estate Tax Proposals. The House budget reconciliation bill HR.

Tpc The Ways Means Reconciliation Bill Would Raise Taxes On High Income Households Cut Taxes On Average For Nearly Everyone Else

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

Everything In The House Democrats Budget Bill The New York Times

President Biden Proposes Tax Changes In Fy 2023 Budget Baker Tilly

The Legacy Of The 2001 And 2003 Bush Tax Cuts Center On Budget And Policy Priorities

How The Tcja Tax Law Affects Your Personal Finances

Manchin Outlines Tax Policy Changes He D Want In Biden Bill Bloomberg

Biden Budget Biden Tax Increases Details Analysis

Will It Or Wont It Newest Reconciliation Bill Lacks Major Estate Tax Law Changes

How The Tcja Tax Law Affects Your Personal Finances

Everything In The House Democrats Budget Bill The New York Times

Retirement Death Tax Bank Reporting Provisions Stripped From Reconciliation Bill For Now

What Happened To The Expected Year End Estate Tax Changes

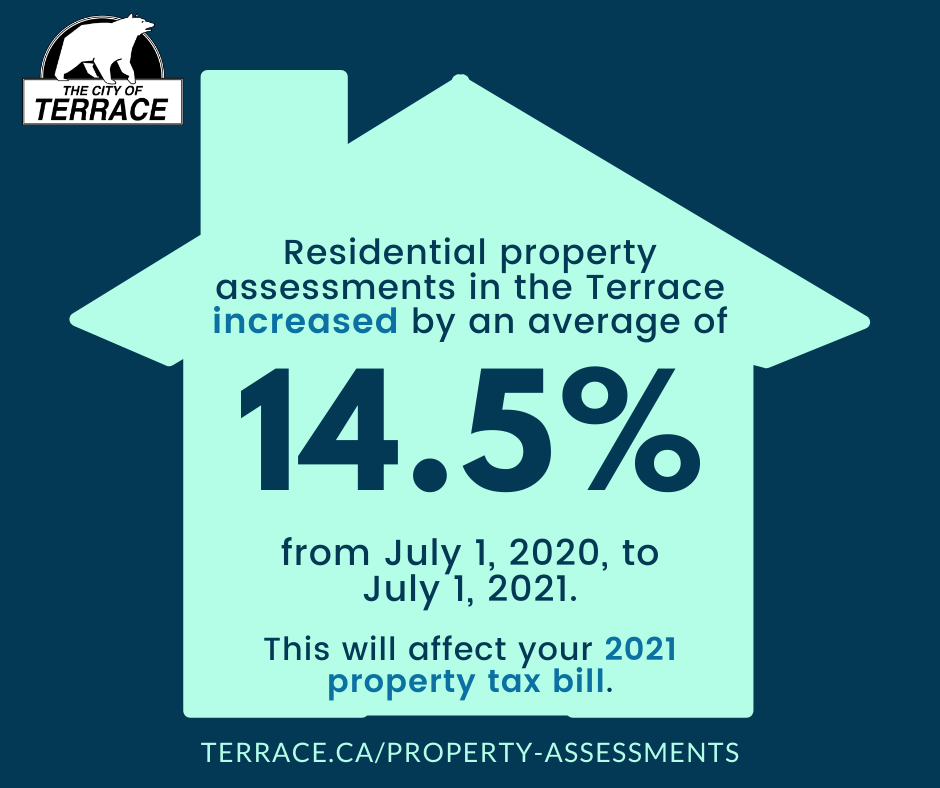

Paying Your Property Tax City Of Terrace

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

New Taxes Will Hit America S Rich Old Loopholes Will Protect Them The Economist